The solidarity surcharge could soon be abolished. The Federal Constitutional Court will announce a ruling on Wednesday. What does this mean for the coalition?

Karlsruhe – Thirty-five years after German reunification, the Federal Constitutional Court could finally abolish the solidarity surcharge. This could pose a threat to the coalition negotiations between the SPD and the CDU/CSU. Judges of the Second Senate in Karlsruhe have announced a ruling for Wednesday, March 26, concerning the surcharge, which is currently only paid by high-earners and companies . Capital gains are also affected. If the surcharge were to be abolished entirely, the federal government would forego annual revenues of twelve to thirteen billion euros.

Decision on solidarity tax: Federal Constitutional Court announces ruling

If the Constitutional Court actually overturns the solidarity tax, the federal government would have to repay approximately 65 billion euros starting in 2020. This would already leave a 78 billion euro gap in the new government’s budget, according to MDR’s calculations. The 500 billion euro special fund for infrastructure would likely not be able to fill this gap. Because the new debt is earmarked and can only be used for new projects.

What exactly is the solidarity surcharge?

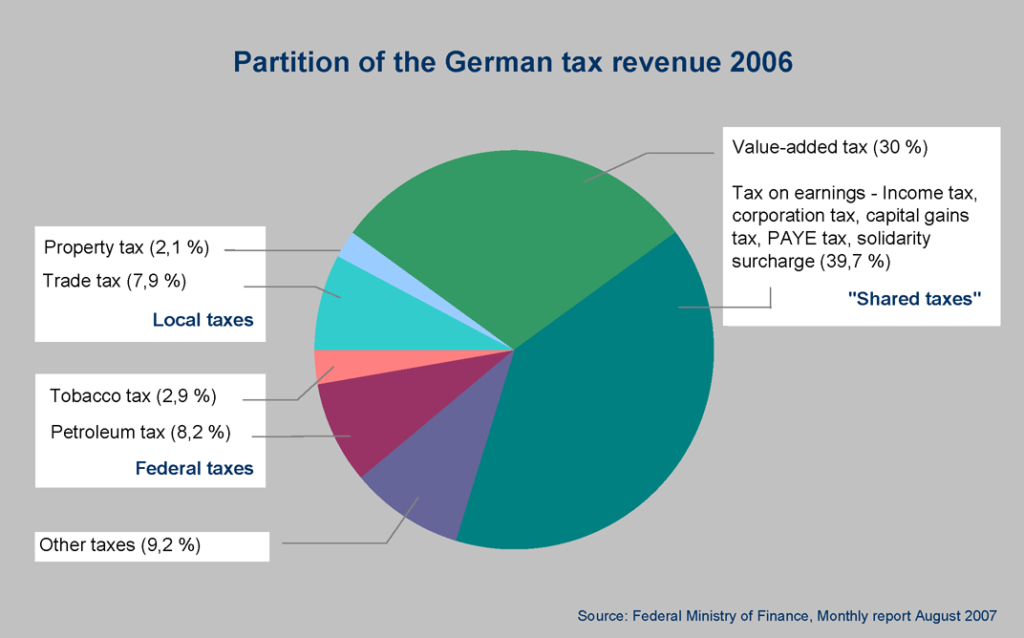

The solidarity surcharge, or Soli for short, was first introduced for a limited period in 1991 and levied indefinitely from 1995 onwards to finance the costs of reconstruction in the East after reunification. Originally, the surcharge was seven and a half percent on wage, income, capital gains, and corporate taxes. Since 1998, the rate has been five and a half percent. The revenue accrues exclusively to the federal government and is not earmarked for any specific purpose. The surcharge is levied in both eastern and western Germany.

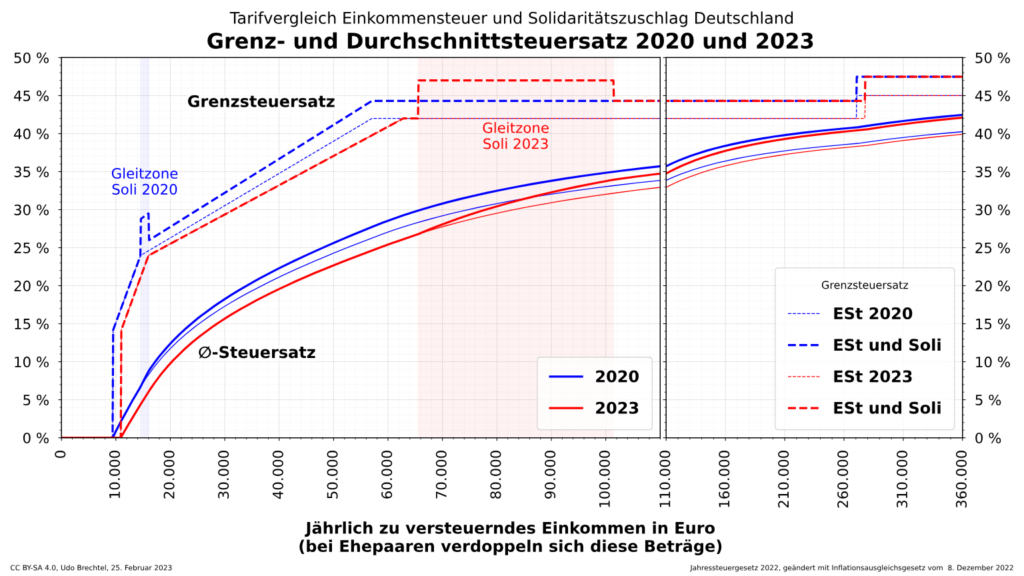

Although the Solidarity Pact expired at the end of 2019, the solidarity tax remained in place – albeit only for a few. Since 2021, significantly higher tax exemptions have been in effect, agreed upon by the then coalition of the CDU and SPD. Around 90 percent of wage or income taxpayers are currently exempt from the tax. However, the solidarity tax remains in place for companies and higher earners. The tax exemptions have been increased annually. In 2024, single individuals with a taxable annual income of around 104,000 euros had to pay the full rate . Investors also pay the solidarity tax on capital gains such as dividends or profits from stocks.

FDP sues the Federal Constitutional Court to abolish the solidarity tax

In 2020, six members of the Bundestag from the FDP, which was then in opposition, filed a constitutional complaint challenging the Solidarity Surcharge Act. The FDP parliamentary group declared: “The solidarity surcharge is unconstitutional and should be abolished – permanently and for everyone.” Wednesday will reveal whether the six FDP politicians will prevail.

The reason for the lawsuit before the Federal Constitutional Court is that the imposition of the surcharge after 2019 is incompatible with the Basic Law. This is at least the argument of the six FDP politicians who initiated the lawsuit. The surcharge was intended to finance German unity, and after the expiration of the Solidarity Pact, the solidarity surcharge was to be abolished for everyone. They believe their right to property is violated by the Solidarity Surcharge Act and criticize the fact that only a portion of those previously subject to the surcharge must continue to pay the surcharge.

Decision in Bavaria on the solidarity surcharge: this is how the Federal Constitutional Court could rule

In January 2023, the Federal Fiscal Court in Munich ruled in a test case that the solidarity surcharge may continue to be levied. The chances are therefore good that the Constitutional Court in Karlsruhe will rule in favor of the solidarity surcharge. A Bavarian couple, with the support of the Taxpayers’ Association, had filed a lawsuit against the payment for 2020 and 2021. The lawsuit was dismissed at the time.

In fact, the Federal Ministry of Finance had barely defended the lawsuit. The ministry was actually supposed to be responsible for levying the solidarity tax, because the sword of Damocles of €78 billion hangs over the federal budget. But during his time in the traffic light coalition, Finance Minister Christian Lindner was , in a sense, on both sides. The FDP leader’s party was ultimately a co-initiator of the lawsuit. Among the six FDP members of parliament who initiated the lawsuit were his parliamentary state secretary Florian Toncar and state secretary Katja Hessel. Christian Dürr, leader of the FDP parliamentary group in the Bundestag, was also among the plaintiffs.

Greens and SPD are in favor of the solidarity tax – Union advocates in its election program for its abolition

In court, the federal government argued that the financial consequences of reunification had not yet been fully addressed. Politicians from the SPD and the Green Party defended the decision to impose the solidarity tax only on high-income earners as economically sensible. Indeed, the CDU and CSU also advocated for the abolition of the solidarity tax in their joint election platform before the federal election . If the Constitutional Court rules in favor of the plaintiffs, this could strengthen the CDU/CSU in its coalition negotiations.

For a supplementary levy like the solidarity levy, the federal government must demonstrate additional financial need. A debate took place in Karlsruhe over whether the levy may continue to be levied if the original requirements no longer apply, but the federal government still needs more money for special reasons. The court consulted tax law experts, who expressed differing views. The ruling by the constitutional court judges is expected on Wednesday. (sischr/afp)

Coalition in spe trembling: It’s about 13 billion euros – will Karlsruhe abolish the solidarity tax today?

The Federal Constitutional Court could strike the remaining amount of the solidarity surcharge from the budget: Since 2021, only higher earners have been paying the tax. If the lawsuit by several FDP politicians is successful, the incoming Merz government faces a new problem.

The CDU/CSU and SPD are still wrangling over a joint coalition agreement, and the future federal government in Karlsruhe could already face the next challenge. The Federal Constitutional Court wants to decide whether the solidarity surcharge is still constitutional. The levy, which was established to finance reunification, generates nearly 13 billion euros in federal spending each year. Will this soon be over? The most important questions and answers ahead of the ruling:

What is the solidarity surcharge?

The solidarity surcharge is levied as a surcharge on income and corporate taxes, as well as capital gains, and amounts to 5.5 percent of the respective tax. After a temporary precursor in 1991/1992, the surcharge was introduced permanently in 1995 in response to the additional financial needs of German reunification. However, like all tax revenue, the money is not earmarked for a specific purpose and flows into the federal budget.

Who has to pay it?

Until the end of 2020, almost all citizens and businesses in both East and West Germany had to pay the solidarity surcharge. Since 2021, only higher earners, companies, and investors have been paying it. It was abolished for 90 percent of taxpayers under the “Law on the Repayment of the Solidarity Surcharge of 1995,” and at least partially for another 6.5 percent.

According to the German Economic Institute, around six million people and 600,000 corporations were currently paying the levy. This year, according to the Ministry of Finance, those who pay at least €19,950 in taxes on their income will have to pay the solidarity levy. This means that all single individuals with a taxable income of approximately €73,500 or more are partially liable for the levy. The full levy is payable for taxable income of approximately €114,300 or more. The limits are higher for married couples or taxpayers with children.

Who is suing against it?

On Wednesday, the court will rule on the constitutional complaint filed by six FDP politicians – including former parliamentary group leader Christian Dürr and former state secretaries of finance Florian Toncar and Katja Hessel. They filed the lawsuit even before the Liberals became part of the last traffic light coalition government.

Why are they complaining?

The complainants argue that the surcharge became unconstitutional with the expiration of the so-called Solidarity Pact II. This pact provided special financial support from the federal government to the eastern German states to help them cope with the consequences of German division. The aim was not only to expand infrastructure, but also to strengthen the financial strength of municipalities and promote the economy.

The Solidarity Pact II expired at the end of 2019. “The purpose of the solidarity surcharge has thus ceased to exist,” Toncar told the German Press Agency. If it is not abolished, there is a risk of an “endless solidarity surcharge loop.”

The plaintiffs also argue that recipients of different incomes are now treated unequally because the tax was abolished in 2021 for only a portion of citizens.

What does the federal government have to say about this?

The federal government, now only in office as a caretaker government, argues that reunification continues to incur costs – for example, in pension insurance and the labor market. Furthermore, according to the Ministry of Finance, a socially stratified tax system is expressly permitted.

What did other courts say about this?

This is not the first time that a high German court has ruled on the solidarity surcharge. In 2023, the Federal Fiscal Court (BFH) in Munich rejected a lawsuit against the surcharge, declaring it constitutional. The plaintiffs. A married couple from Aschaffenburg – had. Together with the Taxpayers’ Association, requested a referral to the Federal Constitutional Court. According to the BFH ruling, however, the federal government convincingly demonstrated. That reunification continued to cause increased financial needs. Even though the solidarity pacts for financing the uniform burdens had expired.

What consequences could the ruling have?

If the court declares the surcharge unconstitutional, it would pose a challenge for the future federal government. The current draft budget for this year includes solidarity tax revenues of €12.75 billion. While tax estimators are even projecting €13.1 billion. This revenue would be lost, leaving the federal government with a painful deficit.

But things could get even worse. The Senate could decide that the state must repay revenue from the solidarity surcharge in recent years. This would amount to approximately 66.5 billion euros from 2020 to 2024.

The political impact of such a decision could be similar to that of 2023. When Germany’s highest court ruled the use of coronavirus loans for climate projects unconstitutional. At that time, a 60 billion euro hole suddenly appeared in the budget. Which ultimately brought down the traffic light government. Should the court overturn the solidarity tax in any way. The negotiators of a new coalition government would have to reconsider their figures. And they are already struggling to agree on urgently needed savings contributions.

Conclusion

The upcoming ruling by the Federal Constitutional Court on the potential abolition of the solidarity surcharge. (Soli) could significantly impact Germany’s fiscal landscape. And the ongoing coalition negotiations between the SPD and the Union. If the court decides to eliminate the Soli. The federal government faces the challenge of addressing an annual revenue shortfall of approximately 12 to 13 billion euros. Moreover, retroactive repayments since 2020 could amount to around 65 billion euros. Potentially creating a total budget gap of 78 billion euros. This financial strain could complicate the formation of a stable coalition. And necessitate substantial adjustments to fiscal policies and budgetary planning.

Sources used:

- With material from the News agencies dpa and AFP, ntv.de, Reuters news agency, BBC News and CNN reports. The content has been independently analyzed and rewritten to provide original insights.

Welcome to TrendFiTech, your go-to source for the latest trending news, technology updates, and financial insights. Our mission is to provide accurate, informative, and engaging content to keep you updated on global trends, innovations, and market movements.

At TrendFiTech, we cover:

✅ Trending News – Stay informed with the latest happenings worldwide.

✅ Technology – Discover innovations, gadget reviews, and tech trends.

✅ Finance – Get expert insights on investments, business, and economic updates.

We are committed to delivering high-quality, original content while ensuring a user-friendly and informative experience.

Thanks!