Dax current: Dax closes well below 23,000 points

Dax current: The German benchmark index failed to maintain the round mark on Wednesday. The majority of investors are acting cautiously, especially in light of geopolitics.

Frankfurt. The DAX slipped below the 23,000 point mark on Wednesday and closed trading below it. The German leading index closed at 22,839 points, down more than 270 points, or 1.2 percent. The day’s low was 22,832 points.

On Tuesday, investors were still optimistic: the DAX closed 1.1 percent higher at 23,110 points. The latest economic data created a positive mood on European stock markets.

Many investors, however, remained cautious on Wednesday. “The uncertainty ahead of the announcement of the new US tariffs is too great for many to enter the market now,” said portfolio manager Thomas Altmann of asset manager QC Partners. “Tariffs on cars in particular could hit many DAX companies hard.”

The focus was on geopolitics: Russia and Ukraine are ready for a partial ceasefire that would include the Black Sea and the energy infrastructures of both countries.

Investors also looked to the USA with interest : US industry unexpectedly achieved an increase in orders in February. Orders for durable goods such as aircraft and construction equipment rose by 0.9 percent, the Commerce Department announced on Wednesday. Economists surveyed by the Reuters news agency had expected a decline in orders of 1.0 percent, following an upwardly revised increase of 3.3 percent at the beginning of the year. The orders are considered an indicator of the economic situation in the USA.

Frankfurt Stock Exchange Opening: Dax continues to rise – record approaches

FRANKFURT (dpa-AFX) – The DAX continued its gains on Wednesday following the previous day’s strong recovery. However, buying activity was not particularly strong: In the first few minutes of trading, the German leading index gained only 0.11 percent to 23,136.24 points. This puts it just a short distance from the record high of 23,476 points it reached last week.

The MDAX , which includes mid-sized German companies, rose another 0.26 percent to 29,003.70 points on Wednesday morning. The Eurozone’s leading index, the EuroStoxx 50, rose only minimally.

The DAX had gained significantly after the profit-taking the previous day, wrote Thomas Altmann, portfolio manager at asset manager QC Partners. However, trading volumes were at their lowest level in five weeks, he pointed out. “This shows that the majority of investors are currently taking a wait-and-see approach. The uncertainty ahead of the announcement of the new US tariffs is too great for many to enter the market now. Tariffs on cars, in particular, could hit many DAX companies hard.”

Stock exchange in the evening: Rheinmetall and Co. score again

The DAX closed trading on Wednesday with significant losses. Defense stocks, on the other hand, gained ground and were once again the winners. New York also saw red signs, with technology stocks in particular under pressure.

The DAX paid tribute to its strong recovery from the previous day on Wednesday. The leading German index lost 1.17 percent to 22,839 points. The MDAX declined by 0.23 percent to 28,864 points. The index, which includes German mid-cap companies, only slipped into the red relatively late.

Investors apparently once again lacked the conviction to see the DAX approach its record high of 23,476 points. Instead, the index fell well below the 23,000-point mark. This coincided with it closing just below its 21-day moving average. This line is popular among investors as an indicator of the short-term trend.

After a strong run on European stock markets, short-term price gains have recently been followed by rapid profit-taking. According to portfolio manager Thomas Altmann of asset manager QC Partners, uncertainty prevails ahead of the announcement of new US tariffs. Many investors are too embarrassed to enter the market now. Car tariffs, in particular, could have a significant impact on many DAX-listed companies, he noted.

leading EuroStoxx 50 index

On the European stage, the leading EuroStoxx 50 index also fell by more than one percent on Wednesday. US stock markets provided no clear impetus, showing a mixed trend at the close of trading here, with the Dow Jones Industrial index remaining relatively stable and the Nasdaq technology exchange posting significant losses. The Dow Jones was last trading down 0.20 percent at 42,503 points. The broader S&P 500 extended its losses to 5,719 points. The Nasdaq 100 technology index also continued to slide, recently down 1.70 percent at 19,942 points.

In light of the tariff disputes, the gap in share price performance between Europe and the US has been widening for some time. According to VP Bank strategist Manfred Hofer, this has also recently been cast into doubt about the megatrend of artificial intelligence, which had long fueled the US tech giants. He believes the emerging economic hopes in Germany are priced in in the short term, but he sees further potential in Europe in the medium term.

Defense stocks are once again the winners

Rheinmetall, this year’s top performer, took the lead in the DAX with a 2.6 percent increase. This was in line with other defense stocks, as Hensoldt and Renk also clearly posted gains after fluctuating performances. Tank transmission manufacturer Renk, which recently joined the MDAX, sees itself on track for further growth in 2025, given its bulging order books.

The second-biggest DAX gainer was Siemens Energy , with an increase of 1.7 percent. A “Handelsblatt” report on the coalition negotiations between the CDU/CSU and SPD, in which the construction of new gas-fired power plants was being discussed, provided fresh impetus. Another topic was the sale of a majority stake in the Indian wind power business.

In the MDAX, Aroundtown turned significant initial losses into a gain of 3.5 percent. In the wake of the real estate company’s annual results, experts initially highlighted the pending decision on a dividend payment. However, Warburg analyst Andreas Pläsier subsequently praised robust figures and a positive outlook. Shares of the internet group United Internet also moved into positive territory, gaining 3.4 percent, pulling those of its mobile phone subsidiary 1&1 along with them. Disappointing outlooks were offset by a dividend surprise at United Internet, which apparently outweighed the concerns of investors.

Tariffs and strong demand support oil prices

Oil prices recently rose, with North Sea Brent crude rising 0.4 percent to $73.31 per barrel and US WTI crude rising by the same percentage to $69.29 per barrel.

Concerns about global crude oil supplies and a decline in US inventories are driving oil prices higher. North Sea Brent crude and US WTI crude are each up around one percent to $73.69 and $69.64 per barrel (159 liters), respectively. “The market is becoming tighter as trade flows shift due to the numerous US measures,” says Ashley Kelty, analyst at the British investment bank Panmure Liberum.

The US recently announced tariffs of 25 percent on all countries that import oil or gas from Venezuela. “This will particularly impact buyers in China, India, and Western Europe,” predicts Kelty. In addition, the US imposed new sanctions on Iran on Thursday – affecting, among others, an independent Chinese refinery and tankers that delivered crude to relevant facilities. At the same time, US crude oil inventories fell by around 4.6 million barrels last week, according to data from the American Petroleum Institute. Analysts surveyed by Reuters had only expected a decline of about one million barrels.

share price: Dax back below 23,000 points

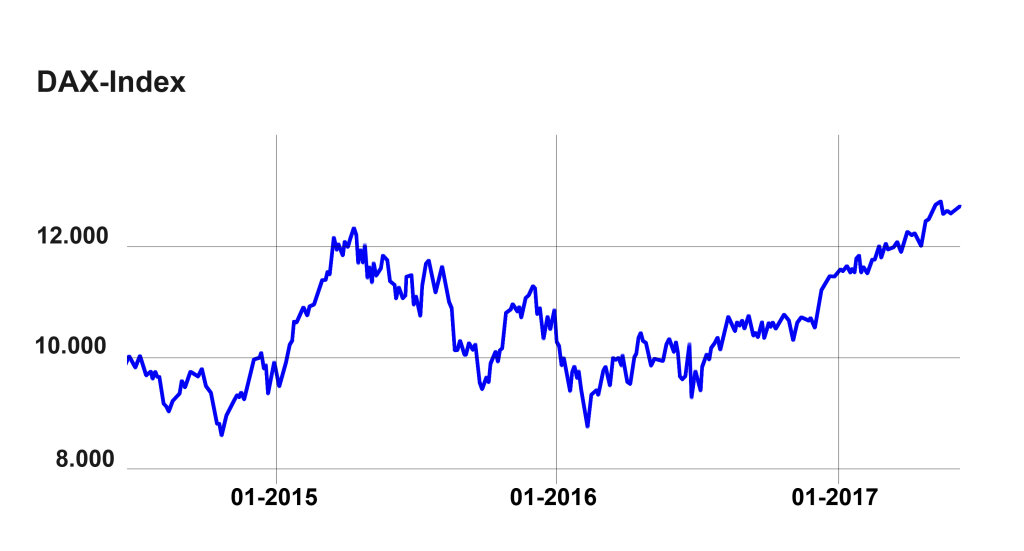

The index of the 40 largest German stock corporations fell temporarily to 22,826.37 points today and lost a total of 1.17 percentage points compared to the previous trading day by the end of the trading day.

Compared to its year-to-date high of March 18, the DAX has lost 2.71 percent to date. The index’s fluctuation range today was 378.22 points. On average, the DAX fluctuates by approximately 110 points. At the close of trading, the DAX was at 22,839.03 points, representing a loss of 1.17 percent compared to the previous trading day. Trading on the Xetra electronic exchange, which accounts for over 90% of German equity trading, ended today as usual at 5:30 p.m. CET. This represents a loss of 0.23 percent for this trading week.

Rheinmetall was the winner in the DAX today, gaining 2.58 percent. Siemens was the day’s loser, declining 1.92 percent. Heidelberg Materials also suffered a decline, falling 1.89 percent, making it the second-worst performer in the leading index.

Trading volume declined significantly compared to the last 30 days: A total of 57,377,376 shares of DAX-listed companies were bought and sold, compared to the monthly average of 94,613,741 shares. This represents a 39.36% decrease compared to the monthly average.

The New York Stock Exchange’s leading index (Dow Jones) is currently at 42,394.69 points, down 0.45% from the previous trading day. The previous high for the year was 45,073.63 points. The Dow Jones Index is currently 5.94% below its annual high.

Data: EOD Historical Data / Status: Wednesday, March 26, 2025, 7:11 PM

This article was generated automatically. Data from EOD Historical Data was analyzed by digitaldaily and evaluated in a stock market report. Price data may be delayed.

Sources used:

- With material from the News agencies dpa and AFP, ntv.de, Reuters news agency, BBC News and CNN reports. The content has been independently analyzed and rewritten to provide original insights.

Welcome to TrendFiTech, your go-to source for the latest trending news, technology updates, and financial insights. Our mission is to provide accurate, informative, and engaging content to keep you updated on global trends, innovations, and market movements.

At TrendFiTech, we cover:

✅ Trending News – Stay informed with the latest happenings worldwide.

✅ Technology – Discover innovations, gadget reviews, and tech trends.

✅ Finance – Get expert insights on investments, business, and economic updates.

We are committed to delivering high-quality, original content while ensuring a user-friendly and informative experience.

Thanks!